Labels

About this Blog

Popular Posts

-

We live during a time of live, real-time culture. Telecasts, spontaneous tweetstorms, on-the-scene streams, rapid-response analysis, war roo...

-

Robotics, AI and automation have long been one of the hottest categories for tech investments. After years and decades of talk, however, tho...

-

Welcome back to The TechCrunch Exchange, a weekly startups-and-markets newsletter. It’s broadly based on the daily column that appears on Ex...

-

2019 was a packed year for commercial space and space startups, but 2020 isn’t likely to see any kind of slowdown. In fact, it’s going to ge...

-

This morning Bunch announced that it has closed a total of $4.4 million in seed capital, including a new $1 million infusion this week. The...

-

Wayve , a U.K.-based self-driving startup that is notable for its use of deep learning and cameras rather than more-costly Lidar and other ...

-

If you’re one of the 12.3 million people who watched Travis Scott perform on Fortnite this past week, you’ll agree: The sky’s the limit righ...

-

The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every ...

-

Welcome back to This Week in Apps, the weekly TechCrunch series that recaps the latest in mobile OS news, mobile applications and the overa...

-

Welcome back to This Week in Apps, the weekly TechCrunch series that recaps the latest in mobile OS news, mobile applications and the over...

About Me

- Elumalai Eswar prasad

- My Name is Eswar prasad From Srikalahasthi and You can learn Many things like:Android tips,Ubuntu and windows tutorials,Gaming ,Tech Hacks and Latest Updates from this Blog facebook gplus linkedin pinterest twitter

Clock for You

Technology

Breaking News

It’s the end of movies as we know them (and I feel fine)

“How Will The Movies Survive The Next Ten Years?” demands the New York Times, in a series of interviews with 24 major Hollywood figures. Good question! I’ve been asking it myself, here, for six years now. Very unlike music, television, books, and home video, the theatrical movie experience has proved remarkably resistant to online disruption…

…so far.

I’ve argued before that Hollywood and Silicon Valley have many parallels: VCs are like studios, angel investors are like individual producers, founders are like directors, etcetera. However, they also have some striking differences. For most of the last 25 years, the cost to launch a groundbreaking, potentially world-shaking startup has decreased — though that may well be changing — whereas the total cost to make, market, and distribute a theatrical release has decidedly not.

Furthermore, movie theaters, built around repeat screening of 90-to-180-minute self-contained films, face new direct-to-streaming-services competition with far more range, from bingewatching 22-episode series to short clips on YouTube. Even in the arena of “movies” as we know them, this competition seems exponentially more intense every year — there’s no way “Bright” and “Bird Box” would have been direct-to-Netflix as little as five years ago — and will hit a whole new fervor with the launch of the Disney Plus launch date later this year.

We can analogize that, maybe, to some extent, to downloadable software vs. software-as-a-service. There can be only one winner, right? Right? And note that, despite the runaway successes of Avengers: Endgame and Captain Marvel, 2019’s US box office is still tracking a full 10% behind last year‘s. There may be a trend here.

It seems that Hollywood is finally aware of the change. Some striking quotes from that NYT piece: “This is the biggest shift in the content business in the history of Hollywood” — Jason Blum. “For a long time, people have been saying the business is changing, but that’s undeniable now” — JJ Abrams. “I don’t feel particularly optimistic about the traditional theatrical experience” — Jordan Horowitz, producer of La La Land. “There’s a lot more work, but it’s a lot harder to make money on anything.” — Elizabeth Banks.

…But with risk comes opportunity, especially for people who haven’t had much before.

“I’ve seen a lot of female filmmakers get opportunities at Netflix and Amazon that they haven’t gotten through the studio system. So I’m very, very happy about the new shape our industry is taking” — Jessica Chastain. ‘A really huge studio told us, “Hey, a woman of color should be the lead of this movie.” And we went, “Great!” I don’t think we would have heard that five years ago from a major studio’ — Kumail Nanjiani

Perhaps “Hollywood,” as the maker and purveyor of huge-budget, huge-footprint, in-theaters-everywhere entertainment, is indeed a dinosaur finally starting to diminish … but if streaming services are allowing more and more people to create scripted entertainment of every kind, on every budget, then their success is no bad thing. I don’t think movies are going to die. I think there will long be people like me, who so prefer the immersive experience of a theater to the in-passing one of streaming at home that we’re willing to pay for it.

But I can envision a future in which a Hollywood Movie is no longer the alpha king of cultural experiences — where, instead, shared worlds spread across many entertainment form-factors, including lower-cost ones, made by a diverse crowd of contributors, take prime position in our collective mindshare. In that future, theatrical releases become a relatively niche market compared to streaming.

In such future the theatrical business model will change, too, and rightly so. I’m still baffled why I couldn’t see the last season of Game of Thrones in any nearby theater, for instance. But there will be far more kinds of entertainment to choose from, undercutting the century-long dominance of “three acts in two hours,” from far more kinds of people. Even to a hardcore cinemaphile like me, the more I think about such a future, the more it seems better to me than the status quo.

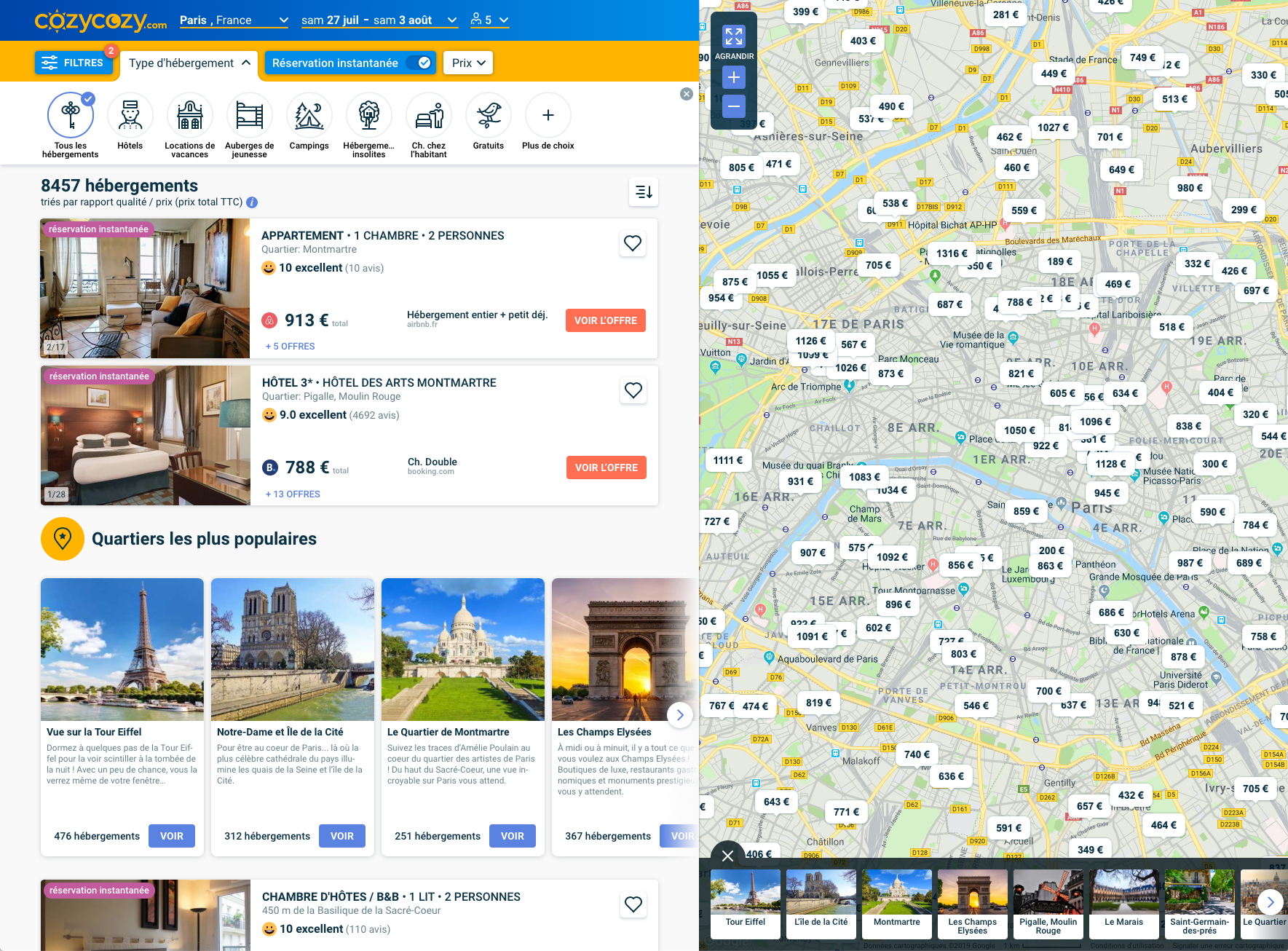

Cozycozy is an accommodation search service that works with hotels and Airbnb

French startup Cozycozy.com wants to make it easier to search for accommodation across a wide range of services. This isn’t the first aggregator in the space and probably not the last one. But this time, it isn’t just about hotels.

When you plan a trip with multiple stops, chances are you end up with a dozen tabs of different services — on Airbnb to look at listings, on a hotel review platform and on a hotel booking platform. Each service displays different prices and has a different inventory.

While there are a ton of services out there, most of them belong to just three companies: Booking Holdings (Booking.com, Priceline, Kayak, Agoda…), Expedia Group (Expedia, Hotels.com, HomeAway, Trivago…) and TripAdvisor (TripAdvisor, HouseTrip, Oyster…). They all operate many different services in order to address as many markets and as many segments as possible.

Cozycozy.com wants to simplify that process by aggregating a ton of services in a single interface — you can find hotels, Airbnb listings, campsites, hostels, boats, home-exchanging apartments… You can filter your results by price or you can exclude some accommodation styles.

The company doesn’t work with hotels and doesn’t handle bookings directly. Instead, the service searches across all the usual suspects. When you want to book, you get redirected to the original listing on Airbnb, Booking.com, Hostelworld, etc.

The startup recently raised a $4.5 million funding round (€4 million) from Daphni, CapDecisif, Raise and many different business angels, such as Xavier Niel, Thibaud Elzière and Eduardo Ronzano.

Cozycozy.com co-founder and chairman Pierre Bonelli also previously founded Liligo.com. It is one of the most popular flight comparison website in France. It was acquired by SNCF in 2010 and then eDreams ODIGEO in 2013.

Week-in-Review: Auditing a dark age in Apple design

Hello, weekend readers. This is Week-in-Review where I give a heavy amount of analysis and/or rambling thoughts on one story while scouring the rest of the hundreds of stories that emerged on TechCrunch this week to surface my favorites for your reading pleasure.

Last week, I talked about how YouTube was letting its commenting system turn from a festering wasted opportunity into a liability.

The big story

Plenty happened this week, though most of the news signified something larger looming on the horizon, more on that in a bit.

One undoubtedly meaty news item was that Jony Ive, Apple’s most iconic executive persona, announced that he was leaving the company this year.

Ive has undoubtedly been a powerhouse of industrial design who has helped craft some of the most iconic products from one of the most influential tech companies. The issue is perhaps what Apple’s vision of industrial design transformed into in his final years at the helm.

Jony Ive is leaving Apple to launch a new firm

Ive shifted away from managerial roles in 2015, but the Chief Design Officer’s influence has been evident it the past several years of very beautiful devices designed around the occasional flawed hypothesis.

Poor design is more than the oft-memed Apple Pencil jutting out of an iPad lightning port or the Mighty Mouse with a charger piercing its underbelly. The company’s aesthetic choices in how they curve their screens or shape their aluminum have stayed true but you don’t have to look too far to find a pattern of carelessness in a number of Apple’s device which occasionally have prioritized svelte profiles over actually even working.

Ive is design genius, but like all people we elevate with that title, he and his design ethos grew further disassociated with the public over time. All designers miss the mark occasionally, but an obsession with minimalism pushed the company in some troublesome directions that the company is only now coming to reckon with.

Apple’s design degradation is perhaps nowhere more visible than in the ill-fated AirPower. The device, which designed to charge your iPhone, AirPods and Apple Watch simultaneously, was beautiful, but Apple’s aggressive design left physics in the rearview mirror. Ambition is one thing but letting function drive form to the point that you publicly announce a product that wasn’t physically possible showcases where Apple’s marketing showmanship butt heads with actual device capabilities. Apple abruptly cancelled AirPower this year, more than a year after its expected release.

If AirPower was a pithy signifier, the degradation of the company’s Mac line has been Apple’s abasement opus.

The problematic keyboards, the useless TouchBar and the shrinking number of ports on its laptops have defined the past five years of the company’s laptop line. There isn’t much that needs to be said about the anti-consumer design decisions that took Apple’s best generation of the MacBook Pro in the 2011/2012 era and cursed it with an unneeded rethinking.

The about-face that the company took on its Mac Pro line shows just how misguided its thinking was and how Ive and company let innovative design poison the good will it had built up with customers. The company’s 2019 line is a total rejection of the 2013 trash can which showcased some major design hubris.

These missteps don’t fundamentally complicate the legacy of Ive or Apple. The past decade has also seen thoughtful designs take shape from the Apple Watch to the iPhone X to the iPad Pro, but industrial design is a means to an end and the manner in which Apple has determined where the customer fits into its design ethos could perhaps use some rethinking as the company enters a new design era.

Send me feedback

on Twitter @lucasmtny or email

lucas@techcrunch.com

On to the rest of the week’s news.

Trends of the week

Here are a few big news items from big companies, with green links to all the sweet, sweet added context.

- SpaceX preps for a Starship payday

Elon Musk is still trying to get SpaceX’s Starship off the ground, but the company’s leadership is already planning for the reusable rocket’s commercial heyday. Read more about the aggressive timeline here. - SF throws Juul the bird

San Francisco doesn’t always operate on the right side of interacting with new technologies and startups, but the city government took final steps to be the first city to ban sales of electronic cigarettes, taking aim at Juul, which seems to be one of the more morally bankrupt SF startups out there. Read more on the ban here. - Reddit takes steps to isolate r/The_Donald

Reddit has had a tough time growing up over the past several years, part of that has been a handful of problem communities on the site. This week, Reddit took the unique step of quarantining r/The_Donald after threats against public officials and members of the police. Read more about the quarantine here. - Tesla’s cell jealousy

Tesla electric vehicles are awfully reliant on Panasonic’s battery cells and the company is investigating how it can reduce that dependency, though the company’s significant demands suggest that even if they succeed in the aggressive move, it would take an awful long time to scale to meet their needs. Read more on the report here.

GAFA Gaffes

How did the top tech companies screw up this week? This clearly needs its own section, in order of badness:

- Facebook’s head of spin makes a push:

[Facebook makes another push to shape and define its own oversight] - FB isn’t sure what to do:

[Facebook’s content oversight board plan is raising more questions than it answers]

Extra Crunch

Our premium subscription service had another week of interesting deep dives. We had a story that should be interesting to a lot of younger founders that are scaling their entrepreneurial ambitions while they’re still in classes.

How to scale a startup in school

“…Once you have a job in an industry you want to be in, network like your life depends on it. Get to know the talented people around you and try to help them as much as you can…”

Here are some of our other top reads this week for premium subscribers. This week, we talked a bit about the future of marketplaces and you should think about naming your startup.

Want more TechCrunch newsletters? Sign up here.

Equity transcribed: SoftBank-backed startup cracks under pressure to scale

Welcome back to the transcribed edition of the popular podcast Equity. This week, TechCrunch writers Kate Clark and Connie Loizos were joined in the studio by Canvas Ventures’ general partner Rebecca Lynn.

This week, the crew talked about the big rounds raised by shoe resale marketplace StockX, which raised $110 million at a $1 billion valuation. And Cameo, which provides personally recorded messages by celebrities and influencers to whomever will pay for them, raised $50 million at a reported $300 million valuation.

The group then discussed Brandless and the amount of money that SoftBank poured into it. Being the recipient of such large sums at an early age adds a lot of pressure to produce.

Kate Clark: …Brandless raised this $240 million round, only one year after launching. So they’re a very young company. And now fast forward another year, SoftBank is pressuring them to be profitable. But right now they’re only two years old. So I mean, what two year old startup is even at that point?

Rebecca Lynn: Well and what other SoftBank company is profitable?

Clark: Yeah.

Connie Loizos: Right.

Lynn: So I think when you look at this, I think for me as an investor, I don’t know the ins and outs of what’s happening here exactly. But for me this just really underscores the importance of having a very aligned set of goals and missions and values and everything else, when you sign up to work with an investor, right? I mean the company and the investor have to be sort of in lockstep. And when you have an investor that hasn’t been around for a really long time and you don’t know how they’re going to behave really in a downturn or when the company runs into bumps.

And I think that kind of behavior sort of through the highs and the lows is a really important thing that founders and other investors need to take a very close look at.

And finally they talked about WeWork’s latest acquisition, Waltz, a smartphone app and reader that allows users to enter different properties with a single credential.

Want more Extra Crunch? Need to read this entire transcript? Then become a member. You can learn more and try it for free.

Researchers developed a sensing system to constantly track the performance of workers

Researchers have come up with a mobile-sensing system that can track and rate the performance of workers by combining a smartphone, fitness bracelets and a custom app.

The mobile-sensing system, as the researchers call it, is able to classify high and low performers. The team used the system to track 750 U.S. workers for one year. The system was able to tell the difference between high performers and low performers with 80% accuracy.

The aim, the researchers say, is to give employees insight into physical, emotional and behavioral well-being. But that constant flow of data also has a downside, and if abused, can put employees under constant surveillance by the companies they work for.

The researchers, including Dartmouth University computer science professor Andrew Campbell, whose earlier work on a student monitoring app provided the underlying technology for this system, see this as a positive gateway to improving worker productivity.

“This is a radically new approach to evaluating workplace performance using passive sensing data from phones and wearables,” said Campbell. “Mobile sensing and machine learning might be the key to unlocking the best from every employee.”

The researchers argue that the technology can provide a more objective measure of performance than self-evaluations and interviews, which they say can be unreliable.

The mobile-sensing system developed by the researchers has three distinct pieces. A smartphone tracks physical activity, location, phone use and ambient light. The fitness tracker monitors heart functions, sleep, stress and body measurements like weight and calorie consumption. Meanwhile, location beacons placed in the home and office provide information on time at work and breaks from the desk.

From here, cloud-based machine learning algorithms are used to classify workers by performance level.

The study found that higher performers typically had lower rates of phone usage, had longer periods of deep sleep and were more physically active.

Privacy experts and labor advocates have long raised concerns about the practice of tracking employees. That hasn’t stopped companies from incentivizing employees to wear fitness tracks in exchange for savings on insurance or other benefits. Startups have popped up to offer even more ways to track employees.

For instance, WeWork acquired in February Euclid, a data platform that tracks the identity and behavior of people in the physical world. Shiva Rajaraman, WeWork’s chief product officer, told TechCrunch at the time that the Euclid platform and its team will become integrated into a software analytics package that WeWork plans to sell to companies that aren’t renting WeWork space but want to WeWork-ify their own offices.

Meanwhile, the team of researchers suggests that while its system of continuous monitoring via wearables and other devices is not yet available, it could be coming in the next few years. It’s unclear if the team is making a calculated guess or if there are designs to try and launch this system as a product.

The team, led by Dartmouth University, included researchers from University of Notre Dame, Georgia Institute of Technology, University of Washington, University of Colorado Boulder, University of California, Irvine, Ohio State University, University of Texas at Austin and Carnegie Mellon University.

A paper describing the study will be published in the Proceedings of the ACM on Interactive, Mobile Wearable and Ubiquitous Technology.

The IPO’d learn investing at First Round’s Angel Track

Startups depend on the angel lifecycle. A few flush post-exit individuals put the first cash into a fresh venture. With some skill and plenty of luck, the early team grows the company into a big success. It sells or goes public and those team members earn a fortune. They then pay it forward by investing in the next generation of startups.

If they hoard their spoils they starve the early-stage ecosystem or leave founders stuck with dumb money from non-strategic financiers. If they redistribute their winnings, they can influence startup culture by deciding what, and more importantly, who gets funding.

But how does a co-founder or VP learn to be a mini-VC? That’s the goal of First Round Capital’s Angel Track, a free three-month workshop series in San Francisco and New York for learning how to source, vet, close, and support angel investments.

A scene from Angel Track’s first cohort

Every two weeks, an expert on some part of the investing process like finding deals or interviewing founders talks to the class, does Q&A, and then leaves the group to openly discuss what they learned and how to use it. Angel Track sessions have been tought by some of the smartest people in the valley like growth master Elad Gil, #ANGELS founding partner and former Twitter VP of corp dev Jessica Verrilli, and Precursor Ventures managing partner Charles Hudson.

Hundreds of startup execs apply for the 15 spots on each coast. After two classes in SF and one in NYC, today First Round unveiled its recently-graduated third cohort from programs in both cities. Those include Lucy Zhang who sold Facebook her chat startup Beluga that became the foundation of Messenger, and Mented Cosmetics co-founder and CEO KJ Miller. By the end of the program they’re taking joint pitch meetings from startups, showing each other the best questions to ask.

As with Y Combinator, it’s as much about the fellowship between new investors as the education. “It’s both a community and a masterclass” says First Round general partner Hayley Barna who oversees the NYC Angel Track. “It’s about bringing a talented group of emerging angels together to build a productive cohort of collaborators.”

She says diversity and inclusion is a big goal of the program, and it features 50% women and 20% underrepresented minorities. Being rich is not a pre-requisite. Barna declares “We’re not pulling in the bankers and the traders doing angel investing as a side-hustle.”

LOS ANGELES, CA – MARCH 29: Confetti falls as Lyft CEO Logan Green (C) rings the Nasdaq opening bell celebrating the company’s initial public offering (IPO) on March 29, 2019 in Los Angeles, California. The ride hailing app company’s shares were initially priced at $72. (Photo by Mario Tama/Getty Images)

After a slew of big 2019 IPOs from Uber, Lyft, Pinterest, Slack, and Zoom, there are plenty of newly-minted potential angels for First Round to teach. The venture firm benefits by building a cadre of co-investors or alternative backers for deals it vets, and through added visibility into the next top fundraises. Unlike some VC scout programs, there’s no formal obligation to send opportunities to First Round or pledge funding alongside it. That keeps it appealing to future investors that innovation hubs need to keep the circle of life flowing.

“A lot of angel investors that got their start in the mid-to late 2000s, they’re almost all fund managers now. They went from angels or super angels to venture investors” First Round partner Brett Berson tells me. “There haven’t been a lot of people who’ve come in and filled that gap”, which could stunt the ecosystem’s growth. Graduates ramp up their angel investing while often staying in their operating roles, though some like former Pinterest head of culture Cat Lee who became a partner at Maveron turn investing into their day job.

“A lot of angel investors that got their start in the mid-to late 2000s, they’re almost all fund managers now. They went from angels or super angels to venture investors” First Round partner Brett Berson tells me. “There haven’t been a lot of people who’ve come in and filled that gap”, which could stunt the ecosystem’s growth. Graduates ramp up their angel investing while often staying in their operating roles, though some like former Pinterest head of culture Cat Lee who became a partner at Maveron turn investing into their day job.

First Round partner Ben Cmelja who helped launch the program explains that “Some people are doing it for the financial return. Some people want access to new ideas and are curious. Some people have a specific type of community they want to support with their investments.”

What Investors Learn From Angel Track

Becoming a successful angel means a lot more than evaluating term sheets. Just like how ideas are a dime a dozen and it’s about who can execute, fundraises are frequent but getting into the right ones takes hard work. First Round focuses on many of the soft skills required to win. Participants receive mentorship on how to:

- Develop an area of expertise and personal brand

- Mine their network for deals and post-investment assistance

- Assess market opportunities rigorously

- Judge an unproven startup’s team and product

- Convince a founder to let them into a round and negotiate terms

- Support their portfolio companies without being annoying

How to approach the delicate power balance of meetings with entrepreneurs can be especially tricky, so I spoke at length with First Round’s Phin Barnes about the session he teaches on founder interviews. I wanted to get a taste for what it’d be like in the classroom, despite First Round declining to let me attend the real thing. Turns out having a journalist in the room can disrupt a safe learning environment for budding angels.

First Round partner Phin Barnes

“Investing is a sell-side product” Barnes stresses. “Capital is a commodity, especially in this market. What you’re saying with a term sheet is that you think the founder’s equity is worth more than your dollars.” That means investors have to close the value gap with sweat.

Barnes gives me what he calls the ‘chocolate soufflé or brownies’ scenario. “The danger of being a smart, talented executive or entrepreneur is that when a founder talks to you about sugar and flour and butter, you start imagining a molten lava soufflé cake you’d build with the ingredients. You invest, and then the founder comes back with a tray of brownies. ‘That’s not what I thought I invested in!'”

The mistake comes in envisioning what you’d do rather than really listening to the founder — the one who’s cooking. Instead of trying to hijack the roadmap or being disappointed by the direction, angels need to help make those brownies as tasty as possible. That means entering into interviews with an open mind.

“You should be positively inclined to invest and have some critical questions. If you don’t think you should invest, you shouldn’t have the meeting in the first place” Barnes explains. “You want to hold that perspective loosely and as new information comes to light, you want to check ‘Am I still interested?’ By the end you want to know what you don’t know, and the open questions you need to answer to validate your hypothesis.”

The four main areas of evaluation are:

The market — Why does this category of product need to exist? What would the world look like if they dominate the category? Can they clearly explain to a five-year old the problem they’re trying to solve? What’s their contrarian thinking? And what motivation will keep them persevering to address the problem despite setbacks and opportunity cost?

The product — Is addressing this specific customer problem unique and defensible? It’s less about if the product is good or bad, or should the button be red or blue. It’s more about how the founder took the inputs and made the decision and how they process information. Have them walk you through the go-to-market plan and see how they shift between high-level strategy and ground-level tactics.

The team — Do they have on-paper talent like PhDs or experience? Can they iterate quickly? You have to weed out victims and look for people who are learners that evolve when faced with adversity. Do your homework on who they are before so you can dig deeper into how they tick. Ask how they show trust in their team and how they get their team to trust them. Have them tell you about the most important thing that happened at the company in the last week to understand their priorities and emotional connection to the process.

The relationship with the founder — Investors need to ask what the best way to work with them is, and what founders are looking for in support from an investor. Do they want a hands-off investor who only chimes in when summoned, or do they expect frequent co-building sessions? Do they need more help accessing a bigger network for hiring and partnerships, or industry-specific expertise to navigate complex decisions?

“We have two roles. We interview and then we coach” Barnes says, providing tips for both. “The very best questions are open-ended. They start with a how/what/why and end with a question mark. Double-barreled questions are terrible. Ask them what would you do, and stop. Get comfortable with silence. They’ll usually fill the silence with something off-script that reveals a deeper truth.” Only once has a founder asked Barnes ‘are you ok?’ in response to his inquisitive stare.

Being able to summarize what you’ve learned lets you quickly cross-check your assumptions with the founder and get helpful corrections. That helps you figure out what questions you still need to ask and keep a diligent list of what you’ll need to research after.

When it comes to giving an answer on whether you’ll invest, “Second best to a quick yes is a quick no with a strong point of view and information for the entrepreneur. The worst is ghosting people. 90% of people operate that way but that’s not the way to do it” Barnes emphasizes. “If you walk out without a yes, no, or what to learn more about in specific detail, you’ve failed as an investor and wasted the time of the entrepreneur.”

The antidote to dumb money

“It was like the perfect mix of your favorite college seminar and a super practical apprenticeship” says Ariana Poursartip, the VP of product for fintech startup Petal who was in the first NYC Angel Track class. “I came away with a better sense of my personal investing approach, and a community of fellow angel investors who I’ll continue to learn from for years.”‘

Fostering better educated angels is crucial for enabling founders. “Dumb money” from investors without expertise in a relevant space, connections they’ll leverage to help, or an understanding of what startups need can be dangerous. It can lead founders to raise more but inefficient capital and make slower progress that puts them at risk of a future down-round that can trigger a startup death spiral.

First Round’s Angel Track cohort 3

First Round is far from the only one trying to fill the angel gap. “Initiatives like Spearhead, YC’s Startup Investor School, and scout programs help lower the barrier to entry for many people who will be terrific and helpful investors for startups” says Cmejla. Sequoia, General Catalyst, Village Global and more run their own scout networks. There are some questionable programs out there too, though, like Venture University which charges from $4,000 to $65,000 for its programs that require students to source deals in exchange for a hazy profit-sharing agreement.

Cmejla insists “It isn’t about providing the capital, a short crash course, or a path to becoming a full-time VC, but about building a durable community that members can lean on and lean into as they level up.” Instead, First Round scores a way to connect founders it funds with relevant angels from its classes. That incentivizes the firm to teach savvy etiquette. Barna warns “You want to be thorough, but if you’re putting in a small check, you can’t ask founders to jump through too many hoops . . . and spend five hours just to get that dinky paycheck.”

Cmejla insists “It isn’t about providing the capital, a short crash course, or a path to becoming a full-time VC, but about building a durable community that members can lean on and lean into as they level up.” Instead, First Round scores a way to connect founders it funds with relevant angels from its classes. That incentivizes the firm to teach savvy etiquette. Barna warns “You want to be thorough, but if you’re putting in a small check, you can’t ask founders to jump through too many hoops . . . and spend five hours just to get that dinky paycheck.”

Past Angel Track participants like Poursartip and Instacart VP of growth Bengaly Kaba tell me they wish the program got them spending more time together both during and after the class, which could spur deeper alliances. “Currently the program ends and there is no formal programming to keep the alumni cohorts engaged and connected” Kaba notes. Many already back startups brought to the class by their peers. Still, Square Cash app product lead Ayo Omojola wanted a stronger structure like perhaps a syndicate so cohort-mates could do more investing together.

What they all cited was the massive value of learning to codify what they’re looking for and what they bring to the table. Kaba highlighted how he enjoyed “Hearing how Elad Gil, [Floodgate co-founding partner] Ann Muira-Ko, Charles Hudson and other guest speakers defined their investment theses around macro trends, industry specific insights, and founder traits.”

When the lock-ups expire on recent IPOs and employees start getting liquidity, “you’re going to see a whole new generation of investors get going over the next couple of years” says Berson.

Not every company spawns the same quality of investor, though. Companies like Uber that empower less-senior team members as the ride sharing company does with regional general managers tend to develop talent with the self-direction and conviction to be great angels. Looking back, you similarly see more angels and founders emerging from more decentralized Google than top-down Apple.

As software eats the world, unicorns proliferate, and the proceeds of tech’s winning streak are spread wide, more and more people will be ready to write angel checks. “It will most likely materially accelerate over the next 12-24 months” Berson concludes. Those without the skills could squander what they’ve earned. Angels who know what makes them special and can evaluate startups without getting swept up in the hype will crown the queens of tomorrow.

What’s up with Lidar, crypto mafias, influencer marketing, Shuttl, and assistive tech

Reminder: Extra Crunch discount on Sessions: Enterprise tickets

Come and watch TechCrunch interview enterprise titans and rising founders at the premier of TechCrunch Sessions: Enterprise in San Francisco on September 5th. Join 1000+ enterprise enthusiasts for a day of talks, demos, startups, and networking.

Book your $249 Early Bird tickets today and save an extra 20% as an Extra Crunch annual subscriber. Just contact extracrunch@techcrunch.com to snag your discounted tickets.

Startups at the speed of light: Lidar CEOs put their industry in perspective

Our science and AI correspondent Devin Coldewey has a blockbuster look at the current state of affairs in the lidar industry. What started as those gyrating “spinners” on top of partially autonomous cars has evolved into a variety of mechanisms like metameterials, all the while VCs have dumped hundreds of millions of dollars on to new ventures.

The big challenge today though is to move from curios in the lab to production-ready hardware prepared for the open road. While some startups have netted early partnerships with car manufacturers like BMW, nothing is set in stone yet, even as a consolidation of the industry seems absolutely imminent.

There’s no shortage of lidar alternatives — as long as you don’t need something that’s ready to roll off the production line.

“Almost everything is in R&D, of which 95 percent is in the earlier stages of research, rather than actual development,” explained Austin Russell, founder and CEO of Luminar. “The development stage is a huge undertaking — to actually move it towards real-world adoption and into true series production vehicles. Whoever is able to enable true autonomy in production vehicles first is going to be the game changer for the industry. But that hasn’t happened yet.”

And

“I’ve been approached at least four times in the last two months with an offer to buy a lidar company,” said Innoviz CEO Omer Keilaf. “It doesn’t surprise me to see some convergence. While there are 20 or 30 car makers, only a few are early adopters — companies like BMW, Daimler, Audi — and they’re built in a way to do that. They have dedicated teams for working with companies like us, making sure everything goes right in such a complicated project. And that trend is even stronger when it’s related to functional safety.”

The rise of the new crypto “mafias”

Accomplice’s lead crypto investor Ash Egan offered up his research onto the crypto world, tracking the lineage of almost 200 startups to determine where they all started. His conclusion is that a handful of institutions — among them Stanford, Google, and Goldman Sachs — lead the pack as the best academies for crypto startup founders.

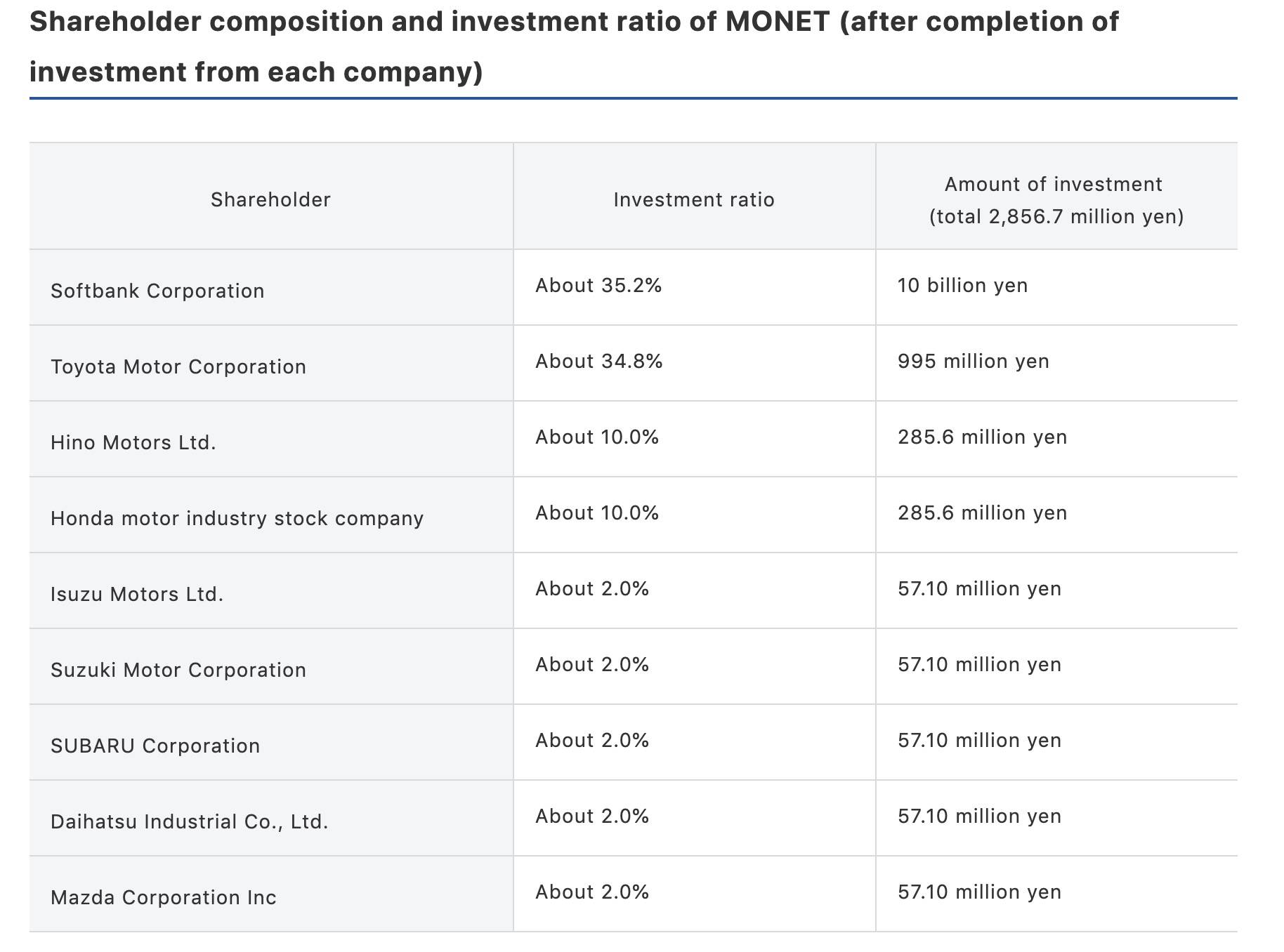

Softbank and Toyota-backed mobility venture gains five more automakers

MONET Technologies, a joint venture launched by Softbank and Toyota to provide on-demand mobility services eventually with an autonomous module bus, has five new partners.

Five Japanese automakers including Isuzu Motors, Suzuki Motor Corp., Subaru, Daihatsu and Mazda will each invest 2% in the venture. Softbank and Toyota each own 35% of the company. Honda and Toyota’s truck-making unit Hino each have 10% ownership.

The venture launched in September aims to launch an on-demand mobility service with buses and cars in Japan next year. Toyota’s autonomous vehicles — based on its e-palette vehicle that debuted at CES 2018 — will eventually become a central piece of the service.

The e-Palette electric vehicle has a modular interior that is designed to allow for it to be used for a variety of services including shuttling people, packages, even mobile food preparation.

The venture involves more than simply investing capital. The automakers are also sharing data. Datasets are essential to build a mobility-as-a-service platform with autonomous vehicles, according to MONET President and CEO Junichi Miyakawa.

Earlier this year, Toyota began piloting an on-demand bus service that lets people order a ride via an app. The pilot was being conducted in the Ohara district within Toyota City. The venture also conducted a demonstration project involving a multi-purpose shuttle for Fukuyama-shi Hattori school district.

Original Content podcast: ‘I Think You Should Leave’ brings deranged laughs to Netflix

A sketch on Netflix’s “I Think You Should Leave with Tim Robinson” doesn’t just settle for one funny idea. As soon as you start to get comfortable and assume that you know where things are going, there’s usually a wild left turn, and sometimes a third and fourth for good measure.

We review the new comedy series on the latest episode of the Original Content podcast, highlighting our favorite sketches and the ones that didn’t work for us — sometimes things stretch out for too long, or the idea can seem more bizarre than funny.

Still, the hit rate feels remarkably high, provoking frequent, disbelieving laughter, with co-creator and star Robinson continually mining new shades of deranged behavior. It helps that there are only six episodes of around 20 minutes each, so “I Think You Should Leave” definitely doesn’t wear out its welcome.

In addition to our review, we follow-up last week’s discussion of “When They See Us” by noting that the show has supposedly been viewed by more than 23 million Netflix accounts.

You can listen in the player below, subscribe using Apple Podcasts or find us in your podcast player of choice. If you like the show, please let us know by leaving a review on Apple. You can also send us feedback directly. (Or suggest shows and movies for us to review!)

If you want to skip ahead, here’s how the episode breaks down:

0:00 Intro

0:40 When They See Us follow-up

8:53 I Think You Should Leave review

17:44 I Think You Should Leave spoilers

Startups at the speed of light: Lidar CEOs put their industry in perspective

As autonomous cars and robots loom over the landscapes of cities and jobs alike, the technologies that empower them are forming sub-industries of their own. One of those is lidar, which has become an indispensable tool to autonomy, spawning dozens of companies and attracting hundreds of millions in venture funding.

But like all industries built on top of fast-moving technologies, lidar and the sensing business is by definition built somewhat upon a foundation of shifting sands. New research appears weekly advancing the art, and no less frequently are new partnerships minted, as car manufacturers like Audi and BMW scramble to keep ahead of their peers in the emerging autonomy economy.

To compete in the lidar industry means not just to create and follow through on difficult research and engineering, but to be prepared to react with agility as the market shifts in response to trends, regulations, and disasters.

I talked with several CEOs and investors in the lidar space to find out how the industry is changing, how they plan to compete, and what the next few years have in store.

Their opinions and predictions sometimes synced up and at other times diverged completely. For some, the future lies manifestly in partnerships they have already established and hope to nurture, while others feel that it’s too early for automakers to commit, and they’re stringing startups along one non-exclusive contract at a time.

All agreed that the technology itself is obviously important, but not so important that investors will wait forever for engineers to get it out of the lab.

And while some felt a sensor company has no business building a full-stack autonomy solution, others suggested that’s the only way to attract customers navigating a strange new market.

It’s a flourishing market but one, they all agreed, that will experience a major consolidation in the next year. In short, it’s a wild west of ideas, plentiful money, and a bright future — for some.

The evolution of lidar

I’ve previously written an introduction to lidar, but in short, lidar units project lasers out into the world and measure how they are reflected, producing a 3D picture of the environment around them.

With a single wiretap, prosecutors collected 9.2 million text messages

For four months in 2018, U.S. prosecutors in Texas collected more than 9.2 million messages under a single court-authorized wiretap order, newly released figures show.

The wiretap, granted by a federal judge in the Southern District of Texas, was granted as part of a narcotics investigation and became the federal wiretap with the most intercepts in 2018, according to the government’s annual wiretap report.

Little is known about the case, except that 149 individuals involved in the case were targeted by the wiretap. The wiretap expired last year, allowing the judiciary to disclose the case.

To date, no arrests have been made

Trailing behind it was another narcotics investigation in the Eastern District of Pennsylvania saw police obtain a three-month wiretap that collected 9.1 million text message from 45 individuals. No arrests were made either.

The two cases represent the largest wiretap cases seen in years.

Wiretaps are some of the most invasive kinds of lawful surveillance in the hands of U.S. prosecutors outside of the federal intelligence community. Where pen registers and trap-and-trace devices allow authorities to see when a call is placed and to whom, wiretaps grant police real-time access to phone conversations and text messages. Given the privacy-invasive nature of real-time listening capabilities, the bar to obtain a court-ordered wiretap is far higher than other surveillance measures.

But the overall number of wiretaps authorized and subsequent convictions “fell sharply” in 2018, the U.S. Courts said in its annual transparency report.

A total of 2,937 wiretaps were authorized in 2018, down 22% on the year prior. The report also said that number of wiretaps using encryption went up, rendering the wiretap ineffective.

Rocket Lab successfully launches seventh Electron rocket for ‘Make It Rain’ mission

Private rocket launch startup Rocket Lab has succeeded in launching its ‘Make It Rain’ mission, which took off yesterday from the company’s private Launch Complex 1 in New Zealand. On board Rocket Lab’s Electron rocket (its seventh to launch so far) were multiple satellites flow for various clients in a rideshare arrangement brokered by Rocket Lab client Spaceflight.

Payloads for the launch included a satellite for Spaceflight subsidiary BlackSky, which will join its existing orbital imaging constellation. There was also a CubeSat operated by the Melbourne Space Program, and two Prometheus satellites launched for the U.S. Special Operations Command.

Rocket Lab had to delay launch a couple of times earlier in the week owing to suboptimal launch conditions, but yesterday’s mission went off without a hitch at 12:30 AM EDT/4:30 PM NZST. After successfully lifting off and achieving orbit, Rocket Lab’s Electron also delayed all of its payloads to their target orbits as planned.

Later this year, Rocket Lab hopes to have a second privately owned launch complex fully constructed and operational, located in Virginia on Wallops Island. The company, founded by engineer Peter Beck, intends to be able to serve both U.S. government and commercial missions as frequently as monthly from this second launch site.

Startups Weekly: What’s next for WeWork?

Hello and welcome back to Startups Weekly, a weekend newsletter that dives into the week’s noteworthy startups & venture capital news. Before I jump into today’s topic, let’s catch up a bit. Last week, I wrote about scooter companies struggling to raise cash. Before that, I noted my key takeaways from Recode + Vox’s Code Conference in Scottsdale, Arizona.

Remember, you can send me tips, suggestions and feedback to kate.clark@techcrunch.com or on Twitter @KateClarkTweets. If you don’t subscribe to Startups Weekly yet, you can do that here.

I’m sure you’re familiar with the co-working behemoth WeWork at this point but if not, here’s a quick primer: The real estate business posing as a “tech startup” offers office spaces to individuals and companies across thousands of co-working spots scattered across the globe.

I’m sure you’re familiar with the co-working behemoth WeWork at this point but if not, here’s a quick primer: The real estate business posing as a “tech startup” offers office spaces to individuals and companies across thousands of co-working spots scattered across the globe.

Led by an eclectic chief executive by the name of Adam Neumann, WeWork made headlines this week after announcing its acquisition of building access app Waltz. The deal represents WeWork’s third M&A transaction of 2019, following that of spatial analytics platform Euclid and office management system Managed By Q. As is often the case, WeWork didn’t disclose terms of the deal.

In the last few years, WeWork has acquired nearly a dozen startups, making it one of the most — if not the most — acquisitive unicorn in the valley. Those acquisitions, a revolving door of venture capital investment and an eventual IPO are all part of WeWork’s world domination plan.

Adam Neumann (WeWork) at TechCrunch Disrupt NY 2017

WeWork filed confidentially to go public this spring shortly after securing new capital from the SoftBank Vision Fund. Now, WeWork is preparing itself for Wall Street’s scrutiny by buying growth, investing in new technologies and doubling down on talented teams. As we’ve pointed out before, WeWork isn’t profitable nor anywhere near profitability. Rather, the company’s value (a laughably high $47 billion) is based on its potential future growth, not its current revenue. Making strategic investments to expand its revenue streams is good business.

WeWork could be a bit more choosy with its deals, though. I will never forget when it took a big stake in Wavegarden, a company that makes wave pools. Yes, really, that happened.

Now that WeWork has officially entered the pre-IPO stage, it must take a closer look at its leadership. The 9-year-old company has an all-male board, something Canvas Ventures’ Rebecca Lynn pointed out to me on this week’s episode of Equity, TechCrunch’s venture capital-focused podcast. We were discussing a new lawsuit filed by former WeWork executives that alleges age and gender discrimination when she noted the troubling statistic.

For a company of that stature to not have appointed a woman to its board by now is mind-boggling. It may be one of the most highly-valued companies in the world on paper, but to succeed as a public company, it has more than one thing to figure out.

Anyways…

IPO Corner:

The Real Real: The marketplace for luxury consignment jumped 50% Friday in its Nasdaq IPO. The company, led by founder and CEO Julie Wainwright, raised $300 million in the process.

Livongo: The digital health business submitted paperwork for an IPO this week, joining a long line of companies opting to go public in 2019. Livongo posted $68.4 million in revenue last year.

Postmates: Google’s vice president of finance Kristin Reinke joined Postmates’ board of directors this week in what was the latest sign the on-demand food delivery startup is prepping for an imminent IPO.

Startup Capital:

SpaceX seeks $300M in fresh funding

Corporate travel platform TripActions secures $250M

Fungible gets $200M from the SoftBank Vision Fund

StockX raises $110M at $1B valuation

Cameo nabs $50M to deliver personalized messages from celebrities

Superhuman secures $33M Series B

SV Academy raises $9.5M to offer tuition-free training for tech jobs

Data!

Social Capital co-founder Chamath Palihapitiya is spinning out a company from his venture capital fund-turned-family-office, TechCrunch has learned. The new entity, temporarily dubbed CaaS (short for capital-as-a-service) Technologies, will focus on providing data-driven insights to VC firms. We’ve got the scoop here.

Elizabeth Holmes, the founder of the now-defunct biotech unicorn Theranos, will face trial in federal court next summer with penalties of up to 20 years in prison and millions of dollars in fines. Jury selection will begin July 28, 2020, according to U.S. District Judge Edward J. Davila, who announced the trial will commence in August 2020 in a San Jose federal court Friday morning.

Extra Crunch:

If you’ve been unsure whether to sign up for TechCrunch’s awesome new subscription service, now is the time. We’ve been publishing a lot of great content, here are my favorites this week:

- What startup names are most effective?

- How to scale a startup in school

- The next service marketplace wave: Vertical market-networks

#EquityPod:

If you enjoy this newsletter, be sure to check out TechCrunch’s venture-focused podcast, Equity. In this week’s episode, available here, TechCrunch editor Connie Loizos, Canvas Ventures general partner Rebecca Lynn and I discuss Brandless’ current dilemma and big rounds for Cameo and StockX.

Huawei can buy from US suppliers again — but things will never be the same

U.S. President Donald Trump has handed Huawei a lifeline after he said that U.S. companies are permitted to sell goods to the embattled Chinese tech firm following more than a month of uncertainty.

It’s been a pretty dismal past month for Huawei since the American government added it and 70 of its affiliates to an “entity list” which forbids U.S. companies from doing business with it. The ramifications of the move were huge across Huawei’s networking and consumer devices businesses. A range of chip companies reportedly forced to sever ties while Google, which provides Android for Huawei devices, also froze its relationship. Speaking this month.

All told, Huawei founder and chief executive Ren Zhengfei said recently that the ban would cost the Chinese tech firm — the world’s third-larger seller of smartphones — some $30 billion in lost revenue of the next two years.

Now, however, the Trump administration has provided a reprieve, at least based on the President’s comments following a meeting with Chinese premier Xi Jinping at the G20 summit this weekend.

“US companies can sell their equipment to Huawei. We’re talking about equipment where there’s no great national security problem with it,” the U.S. President said.

Those comments perhaps contradict some in the US administration who saw the Huawei blacklisting as a way to strangle the company and its global ambitions, which are deemed by some analysts to be a threat to America.

President Trump has appeared to soften his tone on Chinese communications giant Huawei, suggesting that he would allow the company to once again purchase US technology https://t.co/4YNJCyKLTg pic.twitter.com/jr45f40ghP

— CNN International (@cnni) June 29, 2019

Despite the good news, any mutual trust has been broken and things are unlikely to be the same again.

America’s almost casual move to blacklist Huawei — the latest in a series of strategies in its ongoing trade battle with China — exemplifies just how dependent the company has become on the U.S. to simply function.

Huawei has taken steps to hedge its reliance on America, including the development of its own operating system to replace Android and its own backup chips, and you can expect that these projects will go into overdrive to ensure that Huawei doesn’t find itself in a similar position again in the future.

Of course, decoupling its supply chain from US partners is no easy task both in terms of software and components. It remains to be seen if Huawei could maintain its current business level — which included 59 million smartphones in the last quarter and total revenue of $107.4 billion in 2018 — with non-US components and software but this episode is a reminder that it must have a solid contingency policy in case it becomes a political chess piece again in the future.

Beyond aiding Huawei, Trump’s move will boost Google and other Huawei partners who invested significant time and resources into developing a relationship with Huawei to boost their own businesses through its business.

Indeed, speaking to press Trump, Trump admitted that US companies sell “a tremendous amount” of products to Huawei. Some “were not exactly happy that they couldn’t sell” to Huawei and it looks like that may have helped tipped this decision. But, then again, never say never — you’d imagine that the Huawei-Trump saga is far from over despite this latest twist.

A rare glimpse into the sweeping — and potentially troubling — cloud kitchens trend

Independent restaurant owners may be doomed, and perhaps grocery stores, too.

Such is the conclusion of a growing chorus of observers who’ve been closely watching a new and powerful trend gain strength: that of cloud kitchens, or fully equipped shared spaces for restaurant owners, most of them quick-serve operations.

While viewed peripherally as an interesting and, for some companies, lucrative development, the movement may well transform our lives in ways that enrich a small set of companies while zapping jobs and otherwise taking a toll on our neighborhoods. Renowned VC Michael Moritz of Sequoia Capital seemed to warn about this very thing in a Financial Times column that appeared last month, titled “The cloud kitchen brews a storm for local restaurants.”

Moritz begins by pointing to the runaway success of Deliveroo, the London-based delivery service that relies on low-paid, self-employed delivery riders who delivery local restaurant food to customers — including from shared kitchens that Deliveroo itself operates, including in London and Paris.

He believes that Amazon’s recent investment in the company “might just foreshadow the day when the company, once just known as the world’s largest bookseller, also becomes the world’s largest restaurant company.”

That’s bad news for people who run restaurants, he adds, writing, “For now the investment looks like a simple endorsement of Deliveroo. But proprietors of small, independent restaurants should tighten their apron strings. Amazon is now one step away from becoming a multi-brand restaurant company — and that could mean doomsday for many dining haunts.”

The good news . . . and the bad

He’s not exaggerating. While shared kitchens have so far been optimistically received as a potential pathway for food entrepreneurs to launch and grow their businesses — particularly as more people turn to take out — there are many downsides that may well outweigh the good, or certainly counteract it. Last year, for example, UBS wrote a note to its clients titled “Is the kitchen dead?” wherein it suggested the rise of food delivery apps like Deliveroo and Uber Eats could well prove ruinous for home cooks and as well as fresh food providers, including restaurants and supermarkets.

The economics are just too alluring, suggested the bank. Food is already inexpensive to have delivered because of cheap labor, and that will cost center will disappear entirely if delivery drones every take off. Meanwhile, food is becoming cheaper to make because of central kitchens, the kind that Deliveroo is opening and Uber is reportedly beginning move into, as well. (In March, Bloomberg reported that Uber is testing out a program in Paris where it’s renting out fully equipped, commercial-grade kitchens to serve businesses that selling food on delivery apps like Uber Eats.)

The favorable case for cloud kitchens argues that businesses using the spaces are paying less than they would for traditional restaurant real estate, but the reality is also that most of the businesses moving into them right now aren’t small restaurateurs but quick service brands that already have a following and aren’t particular known for emphasis on food quality but instead for churning out affordable food, fast.

As Eric Greenspan, an L.A.-based chef who has appeared on many Food Network shows and has opened and closed numerous restaurants over the course of his career, explains in a new, independent documentary about cloud kitchens: “Delivery is the fastest growing market in restaurants. What started out as 10 percent of your sales is now 30 percent of your sales, and [the industry predicts] it will be 50 to 60 percent of a quick-serve restaurant’s sales within the next three to five years. So you take that, plus the fact that quick-serve brands are kind of the key to getting a fat payout at the end of the day . . .”

During an age when fewer people frequent them traditional restaurants — with their overhead and turnover and razor-thin margins — running one simply makes less and less sense, Greenspan continues.

“[Opening] up a brick-and-mortar restaurant these days is just like giving yourself a job. Now [with centralized kitchens], as long as the product is coming out strong, I don’t need to be there as a presence. I can quality control remotely now. I can go online and [sign out of a marketplace like Postmates or UberEats or Deliveroo] and not piss off any customers, because if I just decided to close the restaurant one day, and you drove over and it was closed, you’d be pissed. But if you’re looking for [one of my restaurants] in Uber Eats and you can’t find it because I turned it off, well, you’re not pissed. You just order something else.”

Big players only need apply . . .

The model works for now for Greenspan, who is running numerous restaurant “concepts” from one cloud kitchen in L.A. Perhaps unsurprisingly, that facility belongs in part to Uber cofounder Travis Kalanick, who was early to grok the opportunity that shared kitchens present. In fact, it was early last year that he announced he was investing $150 million in a startup called City Storage Systems that focused on repurposing distressed real estate assets and turning them into spaces for new industries, like food delivery.

That company owns CloudKitchens, which invites chains, as well as independent restaurant and food truck owners, to lease space in one of their facilities for a monthly fee, along with additional fees for data analytics meant to help the entrepreneurs boost their sales.

The pitch to restaurateurs is that CloudKitchens can reduce their overhead, but of course, the company is also amassing all kinds of data about its tenants in the process that one could seeing using over time. Little wonder that Amazon wants in or that these outfits have at least one serious competitor in China — Panda Selected — that is doing exactly the same thing and which raised $50 million led by Tiger Global Management earlier this year.

No one can fault these savvy entrepreneurs for seizing on what looks like a gigantic business opportunity. Still, the kitchens, which make all the sense in the world from an investment standpoint, should not be embraced so readily as a panacea, either.

Most obviously, they rely on the same people who drive Ubers and handle food deliveries — people who aren’t afforded health benefits and whose financial picture is forever precarious as a result. As with Uber drivers, Deliveroo employees tried to gain status as “workers” last year with better pay and paid but they were denied these rights because they have the option of asking other riders to take their deliveries. The EU Parliament more recently passed new rules to protect so-called gig economy workers, though the measures don’t go far.

Meanwhile, in the U.S, Uber and Lyft continue to fight legislation, including in California, that would turn their drivers and other gig workers into employees. In fact, though a bill passed the California assembly late last month that would give employee status to contract workers, Uber and Lyft are worried enough about its possible passage now in the state’s senate that the fierce rivals have teamed up to battle it.)

Ripple effects . . .

As Moritz suggests, shared kitchens stand to benefit some far more than others. While big chains, and renowned chefs like Greenberg, can take advantage of them given their brand recognition, smaller restaurants are more likely to be adversely impacted by them, and if they disappear, there are other ripple effects, including on housing markets.

Even Matt Newberg, a founder and foodie from New York, could see the writing on the wall when he recently toured CloudKitchen’s two L.A. facilities, along with the shared kitchens of two other companies: Kitchen United which last fall raised $10 million from GV, and and Fulton Kitchens, which offers commercial kitchens for rent on an annual basis.

Newberg is responsible for the aforementioned documentary (which you can also watch below), and he suggests that he most taken aback by the conditions of the first facility that CloudKitchens opened and operates, on West Washington Boulevard in South L.A. Though most restaurant kitchens are chaotic scenes, Newberg said that as “someone who loves food and sustainability” the easy-to-miss warehouse didn’t feel “very humane” to him. It’s windowless for one thing (it’s a warehouse). Newberg says that he also counted 27 kitchens packed into what are “maybe 250-square-feet to 300 square-foot spaces,” and a lot of people who appeared to be in panic mode. “Imagine lots of screaming, lots of sirens triggered when an order gets backed up, tablets everywhere.”

Adds Newberg, “When i walked in, I was like, holy shit, no one even knows this exists in L.A. It felt like Ground Zero. It felt like a military base. I mean, it seemed genius, but also crazy.”

Notably, Newberg says CloudKitchen’s second, newer location is far nicer, as are the facilities of Kitchen United and Fulton Kitchens. “That [second CloudKitchen warehouse] felt like a WeWork for kitchens. Super sleek. It was as quiet as a server farm. There were still no windows, but the kitchens are nicer and bigger.”

Growing pains . . .

Every startup has growing pains, naturally, and presumably, shared kitchen companies are not immune to these. Still, Moritz, the venture capitalist, recalls a telling story in that FT column. He says that in the early 2000s, his firm, Sequoia, invested in a chain of kebab restaurants called Faasos that planned to delivery meals to customers’ homes but was getting crushed by high rents and turnover among other things, so opened a centralized kitchen to sell kebobs. Now, he says, Fassos produces a wide variety of foods, including other Indian specialities but also Chinese and Italian dishes under separate brand names.

It’s the same playbook that Eric Greenspan is using, telling Food & WIne magazine last year that his goal was ultimately to have six delivery-only concepts running simultaneously, with two menus each for breakfast, lunch, and dinner. Greenberg, who is obviously media savvy, can probably pull it off, too, as has Fassos. But for restaurants that are not known franchises or have the star appeal of celebrity chef, the future might not look so bright.

Writes Moritz: “In some markets there is still an opportunity for hardened restaurant and kitchen operators — particularly if they are gifted in the use of social media to build a following and refashion themselves. But they need to move quickly before it becomes too expensive to compete with the larger, faster-moving companies. The mere prospect of Amazon using cloud kitchens to provide cuisine catering to every taste — and delivering these meals through services such as Deliveroo — should be enough to give any restaurateur heartburn.”

It should also worry people who care about their neighborhoods. Cloud kitchens may make it easier and cheaper than ever to order take-out, but there will be consequences, some of which most of us have yet to imagine.

Google finance head joins Postmates board ahead of anticipated IPO

Google’s vice president of finance, has joined Postmates’ board of directors, the latest sign that the on-demand food delivery startup is prepping to take the company public.

Postmates announced Friday that Kristin Reinke, vice president of Finance at Google, will join the San Francisco startup as an independent director.

Reinke has been with Google since 2005. Prior to Google, Reinke was at Oracle for eight years. Reinke also serves on the Federal Reserve Bank of San Francisco’s Economic Advisory Council.

Her skill set will come in handy as Postmates creeps towards an IPO.

Earlier this year, the company lined up a $100 million pre-IPO financing that valued the business at $1.85 billion. Postmates is backed by Tiger Global, BlackRock, Spark Capital, Uncork Capital, Founders Fund, Slow Ventures and others. Spark Capital’s Nabeel Hyatt tweeted the news earlier Friday.

Happy to welcome Kristin to the board of @Postmates.

Great times ahead. https://t.co/nEqu3A2YkE

— Nabeel Hyatt (@nabeel) June 28, 2019

“Postmates has established itself as the market leader with a focus on innovation and route efficiency in the fast‐growing on‐demand delivery sector. Given their strong execution, accelerating growth, and financial discipline, they are well positioned for continued market growth across the U.S.,” said Reinke. “I’m thrilled to join the board.”

The startup has been beefing up its executive quiver, most recently hiring Apple veteran and author Ken Kocienda as a principal software engineer at Postmates X, the team building the food delivery company’s semi-autonomous sidewalk rover, Serve.

Kocienda, author of “Creative Selection: Inside Apple’s Design Process During the Golden Age of Steve Jobs,” spent 15 years at Apple focused on human interface design, collaborating with engineers to develop the first iPhone, iPad and Apple Watch.